The results of fixed marketing are often only visible in the long term, making them difficult to evaluate. Fixed costs: Fixed marketing costs include advertising campaigns, sales forces expenses, sales promotion, and distribution costs, salaries for salespersons, etc.Marketing costs include trade shows, website hosting, advertising, etc.

Marketing costs can be defined as all the expenses that a business incurs to market, sell, develop and promote its products and brand. Including the office, costs can help a businessman usefully allocate money to necessary expenditures. The yearly budget must include the actual and projected office costs to ensure its reliability.

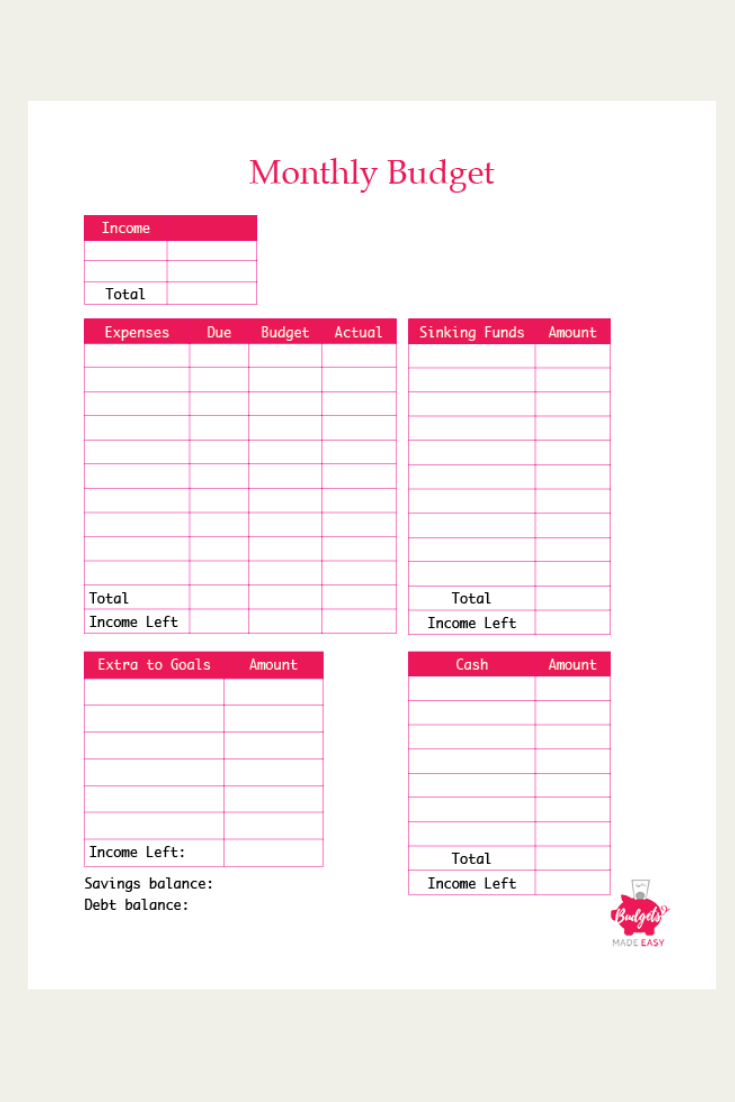

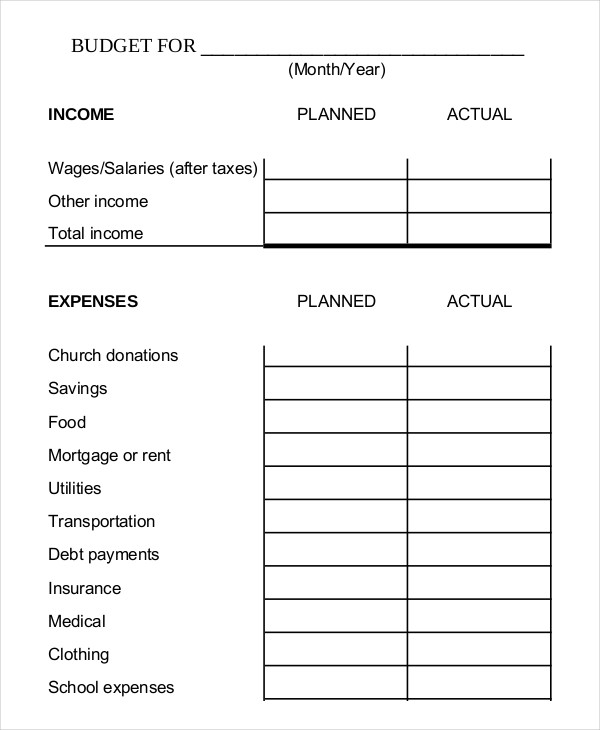

Office costs can include water, electricity, internet, rent, security, and any additional operational costs incurred by a businessman. A businessman can calculate the employee’s labor cost by adding their gross wages to the total cost of related expenses. The yearly budget should contain both the actual and projected employee labor-related cost. A business person should hence include the following information in the yearly budget: Employee costsĮmployee costs are the total costs of employing individuals that a businessman incurs, such as salaries, benefits bonuses, insurance, etc. The yearly budget must therefore contain all the necessary elements which will ensure its usability and effectiveness. Therefore, a person in a business should consider using the yearly budget to identify any areas of unnecessary expenditure by providing a detailed list of expenses and income. Increases profit: Creating a yearly budget increases profit in a business by allocating finances in areas that are likely to increase revenue.Ī yearly budget can help steer a business in the right financial direction and stimulate growth.

A yearly budget can help a business person to calculate the expense variances, which can either positively or negatively impact the business.

0 kommentar(er)

0 kommentar(er)